In our second category trend report, we analyzed hundreds of snack brands on CPGPulse, a new data platform by SnackMagic.

Four ways brands can partner with SnackMagic:

SnackDrop - a gamified way to order, rate, review emerging CPG on mobile.

SnackMagic - The best snacks and sips delivered in a variety of wonderful ways.

SnackMagic Marketplace - Find the brands you love and buy in bulk.

CPGPulse powered by SnackMagic - Real intel on CPG brands. First-party consumer feedback, competitive analysis, and digestible insights.

What you’ll learn in our Snack Trends on CPGPulse Report

Clif Notes: Recent Launches, New Products, and M&A in 2022

18 Snack Categories on CPGPulse

9 Trending Themes on SnackMagic’s Marketplace

Friends & Insights: Diets, Seasonality, Snack Partnerships & Something Corporate

175+ Snacquisitions Throughout History - Scroll allllllll the way down to play M&A!

WeLcOmE tO ThE SnAcK PaRaDe 🎶

I can’t be the only one who smiles when they see the bright, colorful packaging of Joolies, Partake Foods, and SmartSweets on the shelf, followed by the smile your stomach makes when they taste too good to be true. Call this giddy feeling whatever you want. Maybe for you it’s nostalgia or endorphin-inducing packaging or brands designed for kids and kids at heart. What all the snacks in this report have in common is they trigger positive memories of being care-free kids, and temporarily transport us not only to the playground, but to a time when the world was calmer, way before distractions of email notifications and an always-on social media culture.

Idk about you, but I’ve been waiting the majority of my life for the snacks in this report. As the daughter of two chefs, I wasn’t allowed to eat “unhealthy” brands as a kid. And Erewhon didn’t have the elevated inventory it has today back in the 1990s in LA. So buying Hot Cheetos, Oreos, Gushers, and Sour Patch Kids in vending machines or at 7-11 always felt like a tiny act of rebellion. Hope my mom isn’t reading this 😬

Over the last two decades since then, I’ve been watching the growth of the natural products industry both as a consumer and now as a CPG strategist. Many of the brands in this report are actually what inspired me to get involved in our industry as an adult in 2017.

Respect Your Elders

In the 90s, natural, organic, and fair trade versions of unhealthy products were the hot emerging brands at Expo West - think Annie’s mac & cheese, Kettle chips, Pirate’s Booty puffs, Luna bars, YumEarth and Surf Sweets candy, and Dagoba chocolates. The second gen of sustainable brands removed the added sugar and artificial ingredients from classic snacks, I’m talking about leaders like Late July, Justin’s, EPIC Provisions, RXBAR, SmartSweets, Hu Kitchen, Torie & Howard, and Lily’s. The most recent wave of M&A (Perfect Bar, One Brands, Quest Nutrition, Grenade) and new challenger brands are adding in power ingredients to help us get through the day like protein, probiotics, adaptogens, and caffeine - see these in the Making Functional Fun section later in our report.

We’ve Come So Far, But Have a Long Way to Go

70+ of the brands in this report are selling in Walmart, Target, and/or Costco - and have stayed on the shelf for the past few years or more - which is a huge win for better-for-you brands. But alongside all the progress the natural products industry has made since Y2K, we must remember that most of America doesn’t shop organic. This is either because they can’t afford premium groceries or they don’t care about the ingredients in their food. As you build your brand, think about ways you can get your products in the hands of more consumers through reducing prices when possible, focus on low-education / familiar formats and flavors, and partner with schools to help kids eat healthier.

Alongside the fun products in this report, I know all too well that it’s a challenging time for brands who are doing their best to stay in business right now. We encourage founders to find a community of brands like Indie CPG (co-organized by me), CPG House, Snaxshot, Startup CPG, and Naturally Network to share questions, answers, resources, ingredients, and intros. If your brand is featured in this report and you want to meet other founders in here for collaborations, call me maybe?

The Next Big Consumer Diet

Going into 2023, prepare for consumers to be on a hybrid diet, because some days we’re vegan, other days we want less sugar, or at restaurants we’re casually gluten-free. Try to make your products friendly to as many diets as possible without cluttering packaging or sacrificing quality, because I predict next big diet is going to be decided by the consumer, not another 90s blockbuster diet rooted in insecurity. Taking your brand too deep into one diet that has a reputation for being restrictive can turn away consumers who would otherwise be a target customer of a low sugar snack.

And having a product that’s too trend dependent also limits opportunities for retail distribution, fundraising, and M&A - as all three of those audiences are looking for products with mass appeal. There are exceptions, of course, of brands that are tied to one diet that broke through to mainstream audiences. My hunch is this was in part due to consumers not on that diet or lifestyle enjoying the product too.

While some consumers will prioritize weight loss come January coupled with diet popcorn, others will Marie Kondo their pantry to focus on sweets that spark joy. Later in this report, I refer to this trend as IDGAF Indulgence a.k.a. I Don’t Care about nutritional panels… I’m eating this for the flavor or texture and to escape/relax/treat myself for a few minutes. When I helped my mom run her restaurant in 2020, we would sneak freshly baked cookies into every order. This was equal parts a retention and CX strategy to connect with our customers. These cookies made such an impact on the mental wellness of our customers that they would call us to say thank you for brightening their day, and expected them again in their next order.

This theme of indulgence also became clear for me when I conducted a chocolate consumer study for a client. I learned from interviewing a few dozen consumers and surveying hundreds that confections are deeply emotional purchases and experiences, especially in times of stress and uncertainty. During that study I also learned chocolate is one of the few grocery categories where organic shoppers are willing to cheat and eat something they know is bad for them because eating nostalgic chocolate bars makes them feel good. How can better-for-you brands further tap into that childlike sense of delight and wonder?

Inspiration Transparency

This report features 450+ brands, about 200 are on SnackMagic.com. I started with a list of snacks on SnackMagic (without context of their sub-categories), then I added in 200 brands from my Supermercato data. Over the last three months I also visited ten supermarkets in America, UK, Spain, and Italy, and browsed multiple online marketplaces, Faire, and The Dieline, Behance, @onpackaging, @snackgator, @junkpickers, and Thingtesting. Additionally, I discovered 150 brands in this report via Indie CPG; lucky to call many of them friends 🤗

I’m very influenced by music when I write and do market research, and curated a playlist of bubble gum pop & rock that reminded me of this report ➡️

I hope you have as much fun reading this report as we had writing it. Grab your fave snack and an ice cold slushie, and don’t forget to feed your tamogotchi. Btw, brands with a colorful box around them are available on SnackMagic to purchase, the rest of the brands in each category relate to the trend.

Snack Categories on CPGPulse

Cookies

Chocolate

Popcorn & Pretzels

Crunchies

Candies

Dried Fruits

Potato Chips

Confections

Bites

Baked Goods

Meats

Jerky & Plant Based Jerky

Protein Bars

Snack Bars

Puffs

Crackers & Crisps

Functional Bars

Nuts, Seeds & Legumes

Trends on SnackMagic

Feeling Nostalgic

IDGAF Indulgence

Captain Crunch

Making Functional Fun

Sugar, We’re Goin Down

Flavor Trip

Pop Culture

Drinking Buddies

Climate Friendly

Insights from CPGPulse 🍭

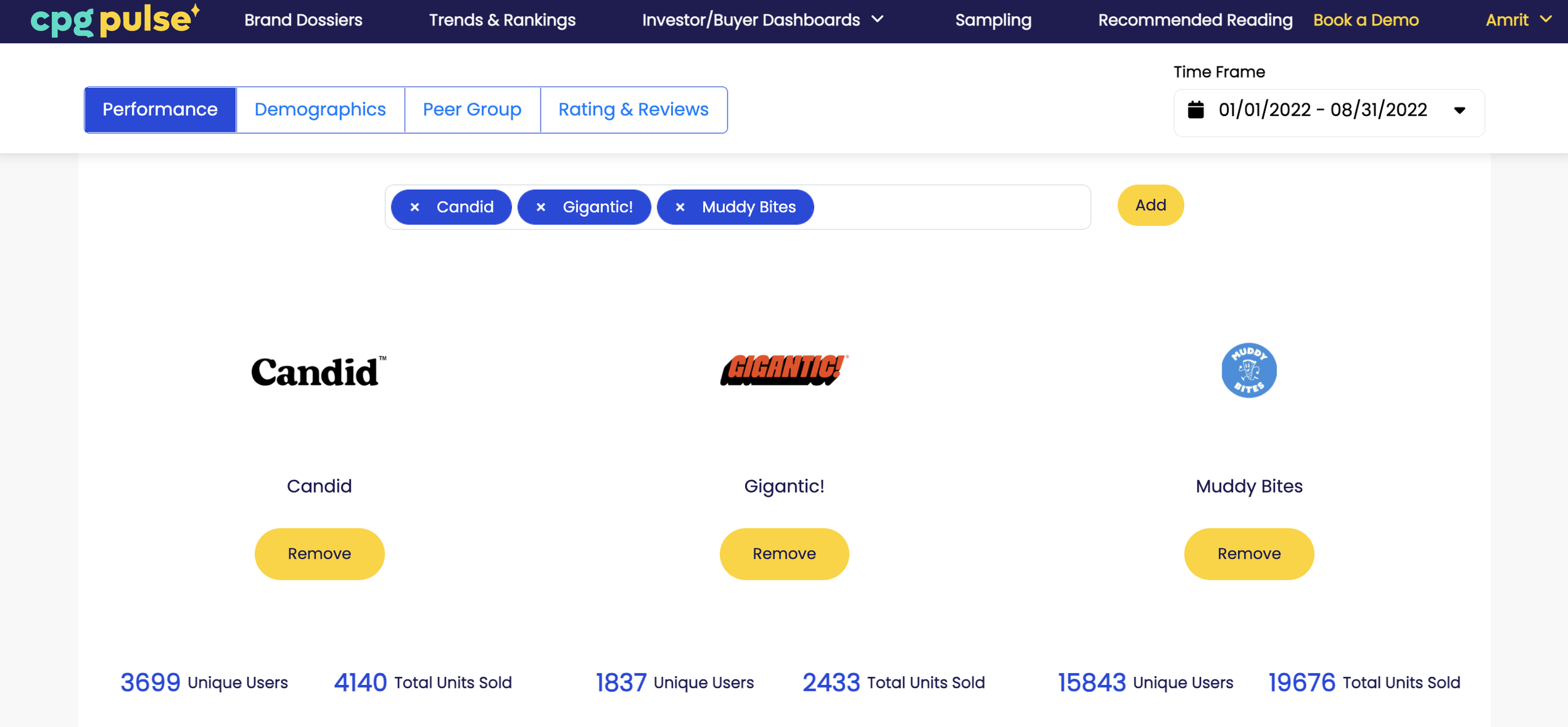

Using CPGPulse we compared sales of Candid, Gigantic!, and Muddy Bites on SnackMagic since 1/1/2022.

Insights from CPGPulse 🍪

Using CPGPulse we compared sales of Belgian Boys, Ethel’s Baking Co., and Milk Bar on SnackMagic since 1/1/2022.

Insights from CPGPulse 🥨

Using CPGPulse we compared sales of Hen of the Woods, SpudLove, and The Good Crisp on SnackMagic since 1/1/2022.

Insights from CPGPulse ⚡️

Using CPGPulse we compared sales of Byte Bars, R.E.D.D Bar, and VERB Energy on SnackMagic since 1/1/2022.

Insights from CPGPulse 🍓

Using CPGPulse we compared sales of BEHAVE, Project 7, and Tazzy on SnackMagic since 1/1/2022.

Insights from CPGPulse ✈️

Using CPGPulse we compared sales of Amazi, Brami, and Favalicious on SnackMagic since 1/1/2022.

Insights from CPGPulse 🍿

Using CPGPulse we compared sales of Hal’s New York, Pipcorn Snacks, and Pop Zero on SnackMagic since 1/1/2022.

Insights from CPGPulse 🍻

Using CPGPulse we compared sales of PREVAIL Jerky, Righteous Felon Jerky Cartel, and UNION Snacks on SnackMagic since 1/1/2022.

Insights from CPGPulse 🌎

Using CPGPulse we compared sales Ancient Provisions, Moonshot, and Pulp Pantry on SnackMagic since 1/1/2022.

Friends & Insights

Snack M&A Throughout History

Notable snacquisitions in the last 5 years have centered around low sugar nutrition bars, high protein (jerky, chips), candy (chocolate, gummies), and nostalgic family favorites like pretzels, popcorn, and cookies.

⚡️ What gives a snack brand acquisition energy? Or how can your brand win the game of M&A?

A mass appeal platform of products representing a trend with staying power, low education - the customer should instantly know what the product is from the front of the packaging and copywriting, national or international retail distribution, effective at DTC and/or Amazon, low COGs, minimal operational complexity that can scale with the support of a larger parent company, family friendly price, formulation innovation/recipe IP, a strong leadership team, fits within a blindspot of the buyer, and/or presents an opportunity for the buyer to to reach customers in new countries or of a different age demographic than their core base.

I predict the next wave of snack M&A will be more about corporations acquiring opportunities more than threats, so keep an open mind about who would be most likely to acquire your brand. Their real competition is companies their own size, not the indie brands.

👀 In addition to recent mega snacquisitions, we’ve seen indie brands expand their portfolios through M&A like LesserEvil buying R.E.D.D., Genius Juice buying Bright Foods, Barnana buying Agroapoyo, Perfect Keto buying SuperFat, Laird buying Picky Bars, Tony's Chocolonely buying Althaea, KIND buying Nature's Bakery and Creative Snacks Co., Stryve buying Kalahari Biltong, and The Good Bean buying Beanitos.

🍪 Additionally, acquired brands like Kodiak Cakes and Birch Benders entered the snacks aisle after first launching breakfast foods.